It’s normal for the price of most products to go up somewhat after time, but it can be quite a shock to many drivers when they see the cost of their car insurance renewal since some of these insurance rates can increase substantially. Fortunately, if you understand the most common factors involved in a rate increase, you may be able to minimize or avoid a major increase in your auto insurance in San Diego, CA. Here are a few reasons insurance rates typically increase.

At-Fault Accident

Insurance rates often rise if you cause an accident that results in a claim being filed. Auto insurance companies might have different criteria for when a claim results in a rate increase, however. For instance, a smaller payout may not require an increase, or companies that offer accident forgiveness will allow one at-fault accident per driver without raising your premium. This coverage is an additional fee included in your insurance policy.

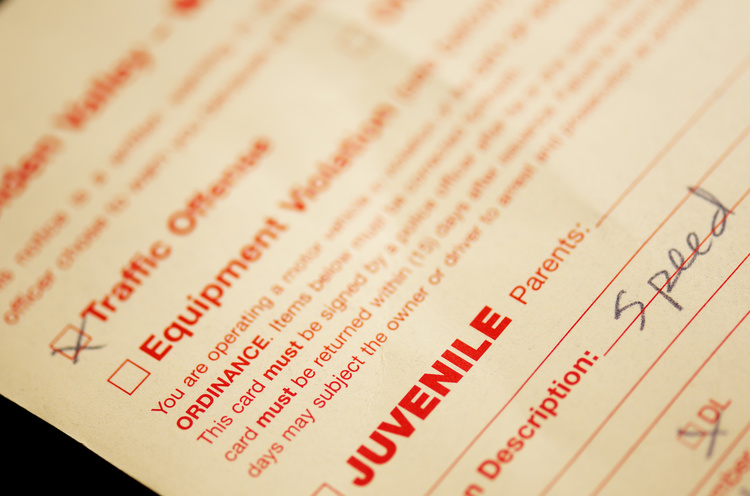

Traffic Violations

Traffic violations are another common reason your premiums may increase. Fortunately, not every violation is created equal. You usually won’t have as drastic of a rate change with a minor traffic violation as you will with a major violation. Minor violations include following too closely, speeding, improper backing or passing, or failure to yield. More serious violations include careless driving, passing a school bus with flashing lights, driving the wrong way, driving under the influence, fleeing from the police, and more. Some insurance policies offer minor violation forgiveness. In addition, if the ticket is dismissed either in court or through traffic school, your record won’t be affected, which prevents rate increases from traffic violations.

Credit Score Drop

When you’re first shopping around for car insurance, a higher credit score can help you get a better rate. In the same sense, a drop in our credit score can potentially make your rate go up, but only in certain states. An insurance broker can help you determine the impact your credit score has on car insurance rates.

Moving

Many drivers are surprised to learn that different locations result in different car insurance rates. Moving to a new state or to an area that requires more frequent driving or more city driving can change your rate. Typically, you won’t pay as much to live in the suburbs or rural areas while major metro areas often have higher premiums simply because the risk of an accident is higher.

Comprehensive Claim

Comprehensive coverage ensures that any damage to your vehicle is covered, whether it’s from another vehicle or from a falling tree or wildlife in the road. Most comprehensive claims don’t cause your insurance rates to rise, but there are some companies that will increase the rate if a certain amount is paid out on a comprehensive claim within a certain time period. Make sure you understand these stipulations when choosing an auto insurance policy.

Insurance Lapse

Allowing your insurance policy to lapse is extremely dangerous not only because it’s illegal to not have insurance, but because the financial impact of an accident without insurance can be substantial. Not only will you usually be charged a fee to reinstate a lapsed policy with the same company, but other companies might view it as a bad sign if you go without insurance. This is especially true the longer the policy has lapsed.

To make sure you have the best auto insurance in San Diego, CA, for a good price, be sure to contact California Brokerage Associates today.